As financial advisors, we focus much of our energy on helping our clients prepare for their financial future. We create strategies to build wealth, plan for retirement, and protect against the unexpected so our clients can have a fruitful future. Yet, many Advisors often fail to prepare for their own retirement and departure from their business. As their business is often their largest financial asset, not preparing to exit well means they are risking their own family’s financial security and future.

A study we conducted in partnership with Environics Research found that almost 90% of financial advisors we surveyed lacked a formalized succession plan.*

For most independent advisors, putting a sound succession strategy in place can be very challenging. Whether it’s defining exit strategy goals, identifying the right successor or purchaser, or knowing how to fully value the worth of their business – each element requires careful thought and preparation to ensure success for everyone involved.

A comprehensive succession plan must include a strategy to ensure your business can continue to function in the event of a disruption or the untimely death of its principal. A business with well documented processes, repeatable client engagement systems, streamlined portfolio offerings, and good compliance ratings helps ensure your business can be easily and confidently valued. The more prepared you are to succeed your business, the more you remove risk of loss from your personal and business balance sheet.

The Complete Guide to Succession Planning for Financial Advisors provides a template for you to map a successful exit from the financial advice business.

Free Succession Webinar for Financial Advisors

with Bonus Templates

What is Succession Planning?

Succession planning is the process of effectively passing leadership of your financial planning practice to a new owner and realizing the maximum equity value from your business.

A complete plan covers the entire process, from goal setting to identifying a successor and planning for unexpected interruptions. It will include:

- Goal setting and time horizons

- Continuity and exit plans

- Choosing and training the right successor

- Establishing the value of your business

- Communication & implementation strategy

Why is Succession Planning Important?

The financial advice business is a highly personal business. Your clients and your business rely on you.

As you approach retirement age, you might want to slow down, spending less time the office and a little more on the golf course. However, the reality is that even if you were able to slow down, the demands of your business and clients may not.

Without a plan to manage the day-to-day, your client service will suffer.

Without the right people in place to deliver a high-level of service, clients will leave.

Without actively managing and growing your business, churn will eat up the value of your book.

Clients will continue to require advice and guidance at every life stage. As clients age and their priorities evolve, they will continue to look to you, and your successor, for that advice.

If executed well, your succession plan will provide enough time to introduce clients to your successor and transition relationships gradually. How you manage this transition phase will help ensure your successor can continue to fulfill your clients' needs, provide advice, and deliver the high calibre of service they expect. This will also protect the value of your business now and in the future. Think of it as a roadmap to putting the right people in the right place, at the right time.

Your succession plan is the roadmap to putting the right people in place at the right time, so that when you're ready, you will get the most value from your financial advice business.

Succession Planning Best Practices

Planning for succession is just one part of protecting the value you’ve built up in your business. Here are some practices that will make your succession planning go smoothly.

Set clear priorities for your succession

Decide what's important to you. Many Advisors have an idea of when they intend to sell their practice, but to gauge whether the exit is successful we need to establish clear exit priorities.

Exit Priorities Examples

- To leave the business within X number of years.

- Transfer the business to a family member or key employee.

- To realize a specific valuation for my financial advice business.

- To ensure my clients continue to receive extraordinary advice and service.

- To achieve and sustain a specific lifestyle for me, my family, and my heirs.

- To realize some of the value from my business, refocus on growth, or make time for philanthropic pursuits.

Support all stakeholders in your transition

The three major stakeholders that your succession plan needs to consider are: You & your family, your staff, and your clients. A complete succession plan will ensure everyone is set up to win.

You and Your Family

- Ensure you have a clear transition plan in place to protect your family's best interests, so you can retire comfortably.

- Maintain good communication about your expectations, goals, and timelines so you're all on the same page in the leadup to your transition.

Your Staff

- Staff continuity is the lynchpin between your current and future business under new leadership. As part of your plan, ensure staff know if they can continue to succeed and grow under new ownership.

- Support staff who intend to stay by clearly defining roles and responsibilities, providing a timeline to integrate with the new team, and preparing staff to expect changes.

Your Clients

- Ensuring the trust your clients have placed in you continues with your successor is vital to client retention. Your actions leading up to the transition will help clients remain confident in a new owner.

- Put your clients at ease with your transition by providing a clear and consistent communication plan and manage client concerns as you introduce the transition.

You Need Three Types of Succession Plans

Three types of plans cover the needs of most Advisors: Business Continuity Plan, Succession Plan, and Exit Plan.

Business Continuity Plan

- Allocate the right financial and human resources to keep your firm up and running if you cannot lead day-to-day operations.

- If there is a serious disruption, whether that’s to your staff, yourself, or your facilities, you will ensure your business will continue to operate, serve your clients, and generate value.

Succession Plan

- Identify the right people to take on the day-to-day role of running your business when you decide to step back.

- This includes a plan to extract equity value from your business and the process for transitioning your clients into the care of your successor.

Exit Plan

- A strategic plan to reduce or liquidate your ownership stake in the business, and to realize the economic value of your hard work over the years.

- Your exit plan identifies how your business will be transferred to another person, team, or entity.

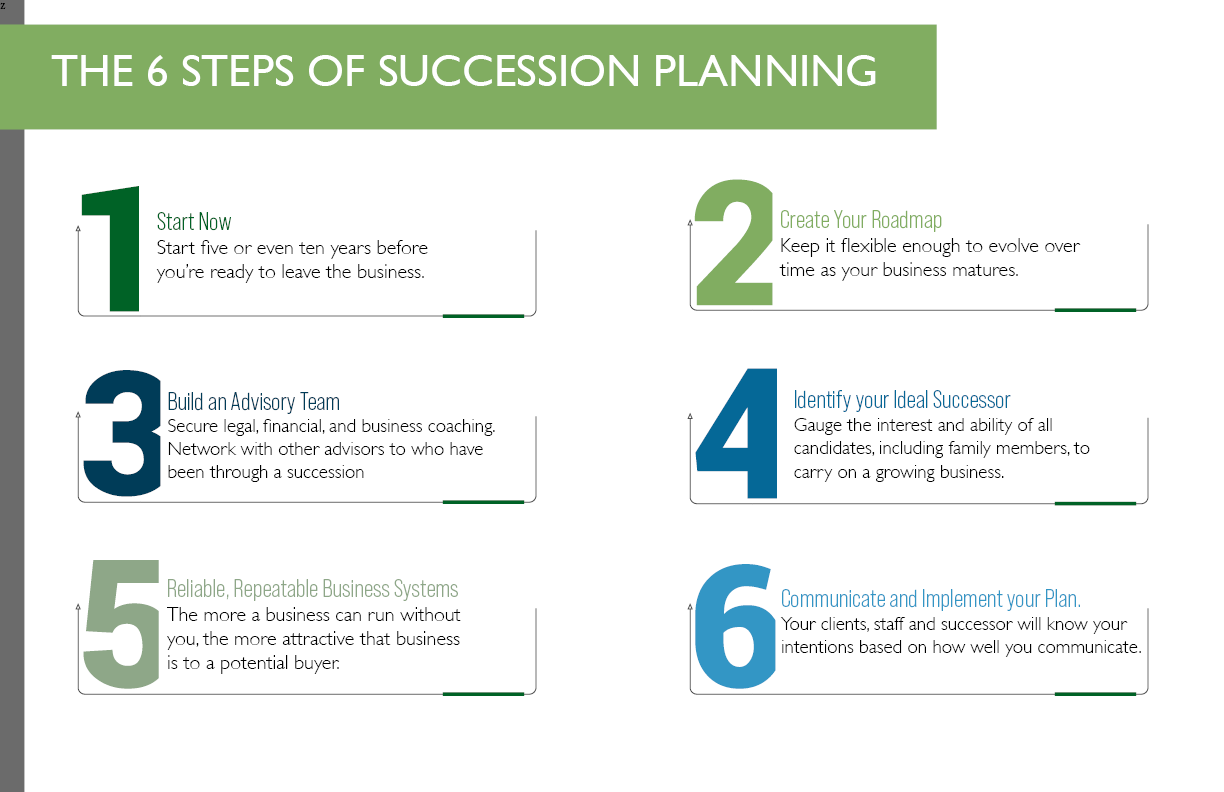

Six Steps to Building a Successful Plan

Step 1: Start now

Two-thirds of advisors say they are at a point in their careers when succession planning is crucial.* No matter your timeline, it’s never too early to start planning out your next steps.

Executing a succession plan well takes time, in some cases up to 15 years to fully implement.

Starting early and giving yourself a generous timeline provides the flexibility you may need to clearly define your objectives, consider your available options, design your ultimate exit, adapt plans as your reality changes and then implement your plan.

Step 2: Create your roadmap

Part of your job is to find the best time to sell or step aside so you can achieve most of your succession priorities. Remember you are creating a guide, not directives set in stone. As you are building your plan, you may find that you have work to do in order to meet your expectations, or that you may need to adjust your expectations to reflect current realities.

Keep your plan flexible enough to evolve as your business matures.

To start building your roadmap:

- Identify your exit priorities

- Choose an exit date

- Know how much you need to retire

- Calculate the price your business will command

- Develop strategies to prepare your business to meet your succession expectations

Step 3: Build an advisory team

The best advice comes from people with experience. Network with other advisors who have been through a succession. Exchange ideas, discuss challenges and successes, and what they might do differently.

You will also need a professional advisory team to guide and validate your assumptions. The team should cover you with expertise in:

- Legal counsel

- Tax and accounting

- Business consulting & exit planning

Step 4: Identify your ideal successor

You have three choices for a succession strategy. Ensure you understand your options and to evaluate the strengths and weaknesses of each one before determining what’s right for you.

Option 1: Hire and train an associate advisor

When you choose to train an associate advisor, your number one concern is whether the successor is interested and capable of being an owner instead of an employee.

Many advisors intend to sell their business to a family member. Just because they are your child, it doesn't mean they have the skills to take over and run the business. It's your job to prepare them for the role.

If you choose to hire and train an outside associate, ensuring your legacy is just as important. Your job is to cast a vision and identify a future owner who is aligned to your values.

Intentional communication is the key to training an associate advisor. Establish a timeline and key progress indicators for your successor. Be intentional about check-ins and follow the plan.

Option 2: Sell to a peer

In addition to finding the right candidate, selling to a peer requires you to develop a joint transition plan and a buy-sell agreement.

Financially, a peer sale carries the risk of multi-year payment plans.

Once you have discussed and settled financing agreements, it's time to develop a transition plan that includes key milestones to carry out an effective transition.

Your transition plan should address the various sources of risks, identifying worst-case scenarios and contingencies, as your successor takes over the business.

Option 3: Sell to a strategic buyer

An institutional buyer – like IPC - will give you the most flexibility to transition on your terms and to guarantee peace of mind for you, your family, and your clients.

An institutional sale will often include a larger portion of the sale price up front and allow you to transition away from the business on your terms, either as a partial sale, a gradual withdrawal, or outright sale.

Your business operations will require a careful review, ensuring you have robust systems and processes in place to help with a seamless handover.

Fortunately, a strategic buyer will provide the proven competence, respected reputation, ongoing administration, and marketing support to deliver an exceptional client experience before, during and after your transition

Step 5: Put Reliable, Repeatable Business Systems in Place

Having well-documented processes and a well-organized book of business will help smooth your transition path and ensure you’re maximizing the value you extract from your practice.

In contrast, too many product strategies or client segments, high client turnover, weak compliance ratings, or non-productive employees are factors that can hurt the value of your business.

Simplify your Offering

Streamline your product offering and ensure you have clear client segmentation and a sound approach to making portfolio recommendations.

Simplifying your offering can create continuity in process for your successor. This will also make your business easier to value and pass on.

Document your processes

If you’re the only person who knows your business processes, portfolio management and client communication strategies, then your business will be difficult to transition. If nothing is on paper it's not systematic.

Keep your processes up-to-date and well-documented, leverage technology solutions to help you stay organized, manage your client engagement strategies, and maintain your compliance records.

Build Strong Equity Value in your Practice

Building equity value in your business and processes will make your practice more attractive to a potential buyer. Steps you can take include:

- Have a clear and well-organized client segmentation strategy

- Streamline your product offering

- Document processes

- Adopt technology to increase your operational efficiency

- Maintain a strong compliance ranking

The best exit strategy is to create a profitable and growing business with loyal clients that can thrive without you. This will help ensure your business and be easily transferred and can continue to run smoothly under new ownership.

Step 6: Communicate and implement your plan

Your successor, staff and clients will know your intentions based on how well you communicate. Your exit from the business should not be a surprise to anybody, and everyone involved needs reassurance about the future.

No client wants to hear that they've been 'sold.' Instead, frame the conversation around the value that can be added by your successor. Establish a communication plan and set timelines for how and when you will start to communicate your retirement plan to your staff, your clients and your family.

As part of your plan, identify how you will introduce your clients and your staff to your successor. Be prepared to answer questions and demonstrate how your clients and your staff will benefit from your transition.

*Research conducted for Investment Planning Counsel by Environics Research, May 2021.

Download your Succession Guide

Start planning your succession today to get the most from your most valuable asset.