The age old saying about the cobbler’s kids having no shoes is one that is often referenced when talking about financial advisors and their succession plans. As financial guides, advisors focus on setting their clients up for success by helping them plan for their ‘what next moments’ and retirement. Yet, many advisors fail to prepare for their own departure from their business, risking their retirement plans. The reason for this could be one of many – busy schedules; too soon to start; uncertainty over where to begin; who to transition to, or what they themselves would do once they’ve retired.

The reality, however, is that the advisor population across Canada continues to age. At the same time, there isn’t a clear path up through the profession for young new entrants into the industry. Couple that with narrowing margins, how technology is changing the way advisory businesses evolve, and how consumers are changing their own preferences for financial guidance, the pressure for advisors to not just think about their succession but, more importantly, to get it down on paper and prepare their successors to inherit, is only becoming more important.

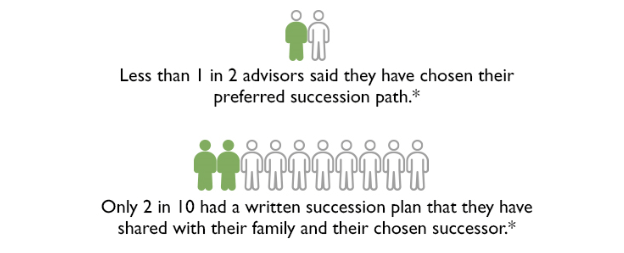

In a recent poll¹, we found that less than one in two advisors have a preferred succession path, while only two in 10 have documented that strategy and shared it with their family and successor.

This lack of preparedness has significance consequence. As an independent business owner, you risk diminishing the value of your legacy, not to mention the potential negative impact to clients who may be left at a loss if something unexpected happened to you.

The Challenge

For most independent advisors, putting a sound succession strategy in place is challenging – whether it’s defining goals, identifying the right successor or purchaser, ensuring a smooth transition of clients, or making sure they’re able to fully realize the value in their business.

The first step to overcoming this is to know the choices you have for your succession path. Then review your business practices and identify what you must implement to structure your practice in such a way that you can indeed maximize its value and sustain your legacy long after you’ve exited the business.

We break-down the three choices you have in our Succession Planning Playbook. The Playbook will help you identify your options, define what “success” looks like for you, and help ensure you protect and prepare your business for your next step, whatever that may be. It also includes a six-step process to help you design your personal action plan.

¹

Poll among advisors who participated at Investment Planning Counsel’s virtual event on Succession Planning for Financial Advisors in July 2020.

Download the playbook and get strategies you can start using today!

Succession Planning eBook Blog Page Form

Thank you for downloading the playbook. Please reach out to us if you'd like to discuss your Succession Strategy.

Please try again later.

Reach out and connect with us if you would like to start a conversation about your succession strategy and learn how we can work with you to help you shape your legacy.

If you'd like to learn how one of our advisors navigated the ups and downs of succession planning when he took over his father's business,

read Barry's story.

Investment Planning Counsel

Aspect

Blog