In navigating buy-sell agreements created for practice succession, parties can run into any number of deal-breaking elements, causing them to walk away from negotiations. This usually changes when family is involved.

Purchasing a book from family can be notably beneficial. Still, getting the most value for your business takes time and a plan. If ignored, each unplanned year can remove a substantial amount from the total you’ll walk away with at the end - whether your successor is family, or otherwise.

Although a family purchase might appear relatively straightforward, the process can actually take longer than average, and much longer than you might guess at the outset - a fact I know all too well.

Rolling with the punches

It was 2001 when I first thought about moving from Ontario to Nova Scotia, to take over the East Coast practice my father started in 1990. Succession for my father, along with thoughts of a better lifestyle for my family, all made the move seem like a good course of action for everyone involved.

What I couldn’t foresee at the time, was the litany of tests life would throw at me. The largest life changes were positive, but the combination of various other elements challenged some of my carefully laid plans.

While my family agreed that I would take over Hennigar Planning from my dad, Robin and his wife, Janet, my move to Nova Scotia was delayed for a year when my own son was born.

Later, after selling my book to the branch owner I worked with in Toronto, I moved my family to Nova Scotia to begin the massive task of meeting with clients, tracking transfers, and buying a home, all while moving offices and still conducting regular business.

Around the same time, I found out that my attempt to get licensed in Nova Scotia was delayed, as Investment Planning Counsel (IPC) worked to navigate inter-provincial inconsistencies, and help my office become the first dual-licensed IPC practice in the province. 1

"The longer my father was around, the more continuity there was for our clients. It can’t be measured, but if I tried to move everyone within two years, I believe there might have been more clients lost."

For six months, I couldn’t solicit business in Nova Scotia. All I could do was focus on insurance, and our out-of-province business operations.

Following that, the 2008 market correction happened, making everyone reluctant to proceed on schedule. My father stayed, a move that undoubtedly helped with client retention during that time, but it did require an additional outlay of unforeseen expenses. Then, our firm’s lone assistant quit the business - I have since hired another - and believe she has been the lynchpin of my day-to-day operations.

On arriving in Nova Scotia, I found out that client portfolios were all over the place. Streamlining this to move forward with my own plans for future growth, also meant selling a block of Hennigar Planning’s original client base.

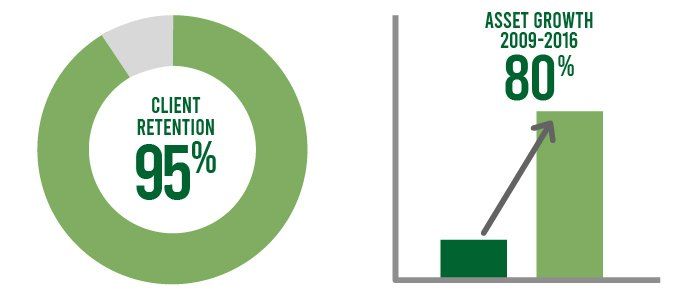

Moving to the IIROC platform, meanwhile, allowed me to create a “tidier” book, and manage more consistent portfolios that are clearer for clients, as well. As a result, my business grew an additional 80 per cent over the next five years after my father left in 2009.

I can now see what everyone has, and how everything is doing at any given time. By being on the IIROC platform too, I am able to gain wallet share from my clients - investment assets and insurance – as I can bring them on-board through this platform. So, I may not grow my number of households greatly every year, but I can manage more for my clients and bring their assets together into one place.

My results

Plan your own exit - sooner rather than later

Interestingly, the lessons I've learned have very little to do with potential difficulties, and everything to do with client value.

Slow was better due to the effort to move clients from my father’s MFDA practice to the IIROC book I was building. I wasn’t about to compel people to move at a time when markets were down one-third.

Although five years is often bandied about as the time needed to prepare and sell a practice for its fair price and walk away, my experience is a clear indication that no two transitions are identical, and life will rarely let you do things exactly by the book.

By the time my dad truly retired and left the practice, people knew me. It can’t be measured, but if I had tried to move everyone in two years, I believe there might have been more clients lost. So, although the acquisition of my father’s business took much longer to complete, I had successfully retained over 95% of the household names. Being agile and able to adjust my plans as my personal circumstances and the market changed were important.

My advice for advisors:

If you are looking to sell your book of business to a family member, it’s important to check the tax status of your sale proceeds ahead of time. Selling to family members is not always viewed the same from a tax perspective as it would be if the sale is to an arm’s length buyer. This, of course, can be costly.

Your business could be worth what you think, but factors - both in your control, and not - can make it worth far less. By failing to plan, a typical book will suffer lower client retention rates on transition, and carry with it the potential for higher, longer-term business reputation risk - all of which makes your book less valuable to prospective buyers.

Business quality is a long game

Having a succession plan in place is only the first step to ensuring the business you’ve built is successfully transitioned and your legacy isn’t diminished. At IPC, we work with Advisors who are looking to either buy or sell a book of business.

Barry is an example of the difference it can make to have a team helping you navigate your succession journey. If you want to hear other real life succession journeys from our Advisors, watch this webinar by using the password: discover.

Apart from working with Advisors to identify suitable partners for a buy or sell, we can share knowledge on the factors that influence purchase or sale prices and work with you throughout the time it takes to develop or refine your succession strategy and post-succession growth plan.

1 Canadian Securities Administrators (CSA) registration reforms, implemented in the second half of 2009, have since streamlined and harmonized registration requirements across all Canadian provincial jurisdictions.

Investment Planning Counsel

Aspect

Blog