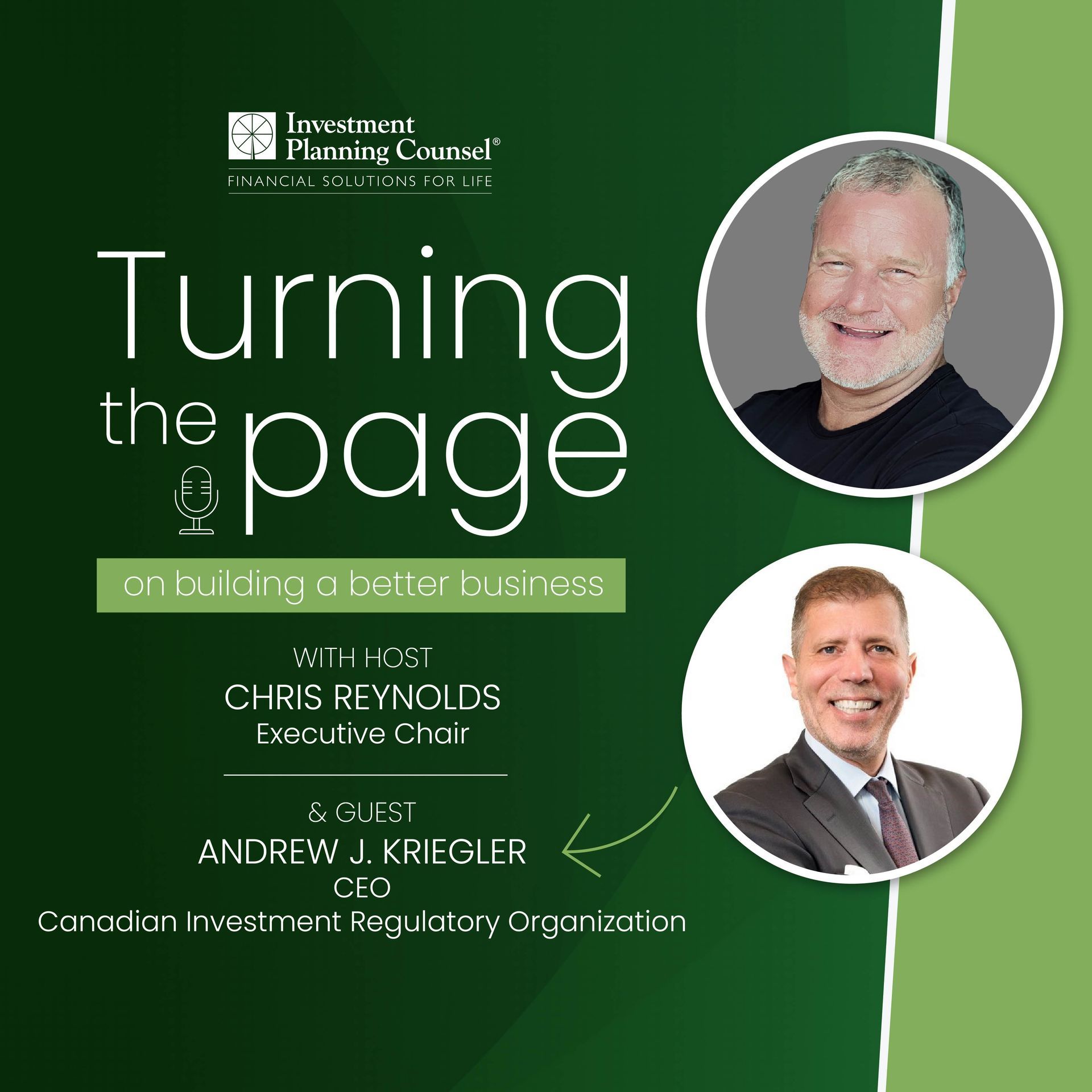

CIRO CEO Andrew J. Kriegler talks about the motivation for merging IIROC and MFDA.

Andrew delves into the advantages of the merger for both advisors and consumers while also exploring the challenges his team encountered along the way.

Add your title here

This is the text area for this paragraph. To change it, simply click and start typing. Once you've added your content, you can customize its design by using different colors, fonts, font sizes and bullets. Just highlight the words you want to design and choose from the various options in the text editing bar.

This is the text area for this paragraph. To change it, simply click and start typing. After adding your content, you can customize it.

As we continue our series of conversions with the regulators, today I’m talking with the new CEO of Canadian Investment Regulatory Organization (CIRO), Andrew J. Kriegler.

In this episode, we discuss…

The purpose of an SRO and the story behind the merger of IIROC and MDFA.

The benefits of the merger for advisors and consumers.

The challenges Andrew and his team are facing through the merger process.

The recent white paper that was issued regarding commission redirection

Andrew J. Kriegler is the inaugural CEO of the Canadian Investment Regulatory Organization (CIRO) formed on January 1, 2023, through the amalgamation of the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA).

In late 2014, Andrew was appointed President and CEO of the Investment Industry Regulatory Organization of Canada (IIROC), CIRO’s predecessor organization. Before coming to IIROC, Andrew served as Deputy Superintendent of the Office of the Superintendent of Financial Institutions (OSFI) where he was responsible for the prudential supervision of Canada's federally regulated financial institutions. He also spent 25 years in the private sector, most recently as Treasurer of CIBC from 2008 to 2012, and earlier as Senior Vice President & Chief Human Resources Officer of Moody's Corporation, parent of the credit rating agency Moody’s Investors Service, where he had been the Canadian Country Managing Director.

Andrew has also worked as a treasury executive, as a securitization and debt capital markets banker, as an analyst and then a trader on a mortgage-backed securities trading desk.

What do you do in your business to make sure you are compliant? How do you protect not only yourself but your clients? Let’s have a virtual coffee and talk about it.

Schedule a virtual coffee with me using the form on the right.

If you’ve found this episode useful, or know of someone who could gain from it, I’d appreciate it if you would share it with them. Or subscribe and follow Turning the Page on Apple, Spotify or whatever podcast app you use!

Cheers,

Chris

Grab a Virtual Coffee with Chris

Would you like to spend 20 minutes with me - virtual coffee in hand – furthering the conversation you heard in any of the podcasts?

Want to be or being a guest on the show? Fill out the form and let me know!

EP51 - Ep - 51 Learning About the Canadian Investment Regulatory Organization with CEO Andrew J. Kriegler

Investment Planning Counsel

Aspect

Blog