Having regulators oversee a business can often be percieved as the business' integrity being questioned, which is often not the case.

CIRO's Karen McGuiness tells us exactly what regulators are looking for when ensuring businesses adhere to the regulatory framework .

Add your title here

This is the text area for this paragraph. To change it, simply click and start typing. Once you've added your content, you can customize its design by using different colors, fonts, font sizes and bullets. Just highlight the words you want to design and choose from the various options in the text editing bar.

This is the text area for this paragraph. To change it, simply click and start typing. After adding your content, you can customize it.

Although all of us wished we lived in a world where everyone played fair, we know there’s no such place. In every industry, there are regulators to keep the consumer safe, especially in the financial industry.

I have said this before: We are in the business of trust. People trust that the advice we give them is in their best interest.

Regulators are there to make sure that we are following a consistent methodology and have the notes and paperwork to prove it. This is not an enviable role to play. Believe it or not, entrepreneurs sometimes don’t like their integrity being questioned or to show their work. This can cause undue friction because after all they are only doing their job.

At our recent National Fall Summit in Halifax for advisors, we had the pleasure of hosting a fireside chat with today’s guest. And as I sat in the audience, I realized that the regulators never really get to tell their side of the story and their perspective.

That changes now.

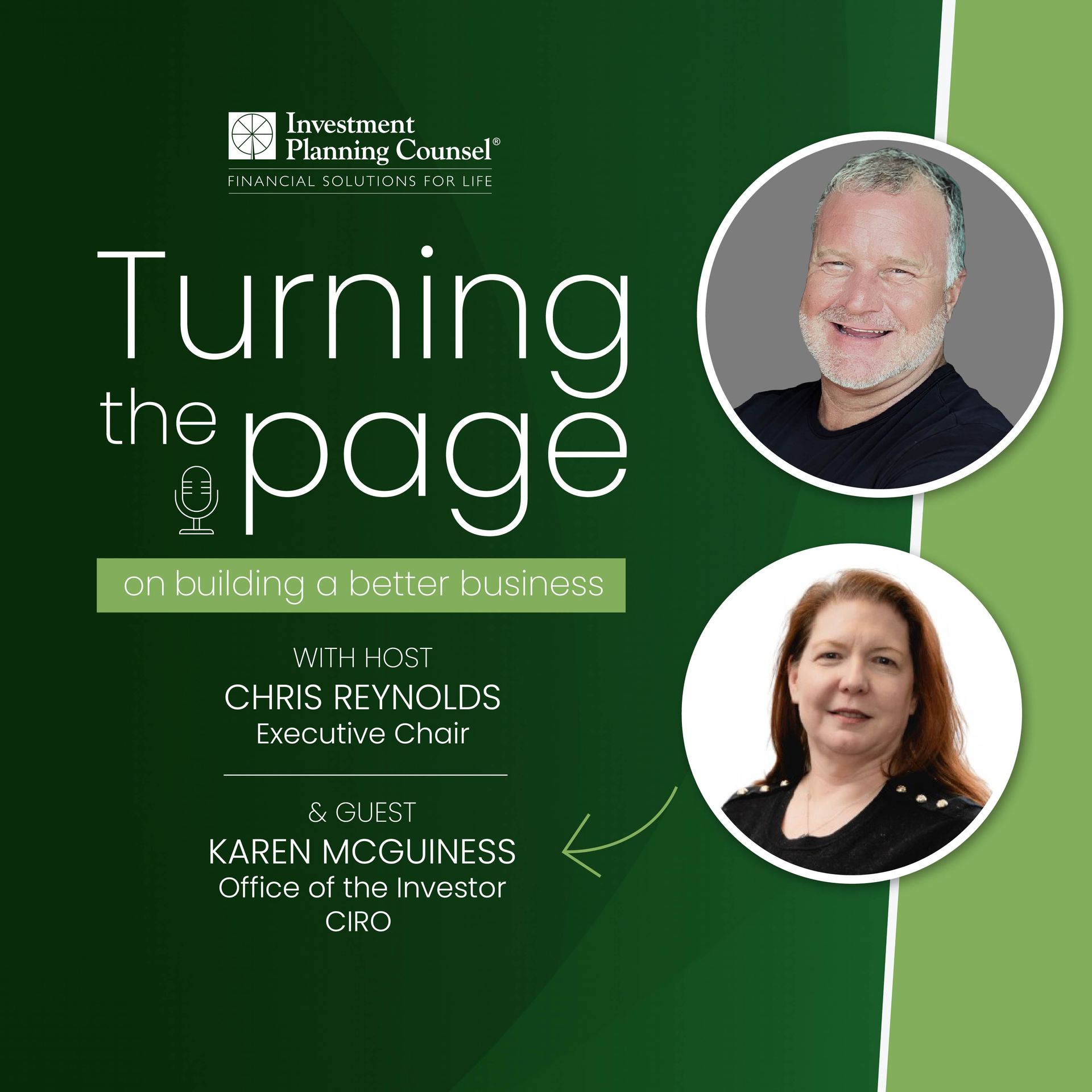

On this episode, I chat with Karen McGuiness who runs the new ‘Office of the Investor’ at the Canadian Investment Regulatory Organization (CIRO). She was previously president & CEO of the Mutual Fund Dealers Association (MFDA), and has held positions at the Enforcement branch at the Ontario Securities Commission (OSC). She is quite the authority on regulations, the (Self-Regulatory Organizations) SROs and what exactly regulators are looking for out there.

What do you and your team do stay compliant? How do you work to build and show trust with your clients? I’d love to hear what you do over a virtual coffee! Book with me on the form on this page.

Follow the podcast on Instagram at https://www.instagram.com/turningthepage_podcast/

If you loved this episode, I’d appreciate it if you would follow Turning the Page on Apple, Spotify or whatever podcast app you use! If you found the information helpful, be sure to share it with another financial advisor who could use these words of wisdom!

Grab a Virtual Coffee with Chris

Would you like to spend 20 minutes with me - virtual coffee in hand – furthering the conversation you heard in any of the podcasts?

Want to be or being a guest on the show? Fill out the form and let me know!

EP48 - Ep 48 - Learning About the Office of the Investor with CIRO’s Karen McGuiness

Investment Planning Counsel

Aspect

Blog